Introduction

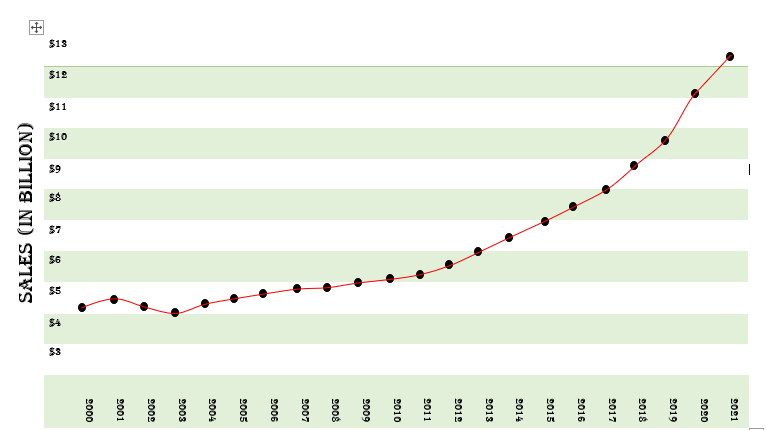

The Nutrition Business Journal (NBJ) reports that herbal dietary supplement retail sales in the United States will reach $12.350 billion in 2021. After 2020’s record-breaking 17.3% increase from 2019, this is these products’ second-strongest annual growth. This equates to a rise in total sales of 9.7% when compared to the previous year.

In 2021, customers spent $1.089 billion on herbal supplements, combined with the $1.659 billion increase in sales in 2020. It represents an increase in total sales for four years before the COVID outbreak in the United States.

First, Let’s Focus On The Mainstream Channel.

Elder Berry

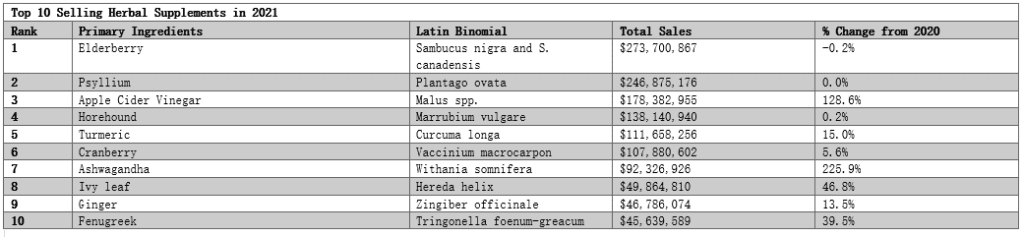

It will be the top-selling herbal supplement in mainstream retail outlets in 2021. Elderberry’s mainstream sales have decreased for the first time since 2012. The mainstream sales of elderberry supplements decreased by 0.2% in 2021, but they continued to grow, reaching $273,700,867, a decrease of less than $2 million from 2020.

The term “elderberry” refers to the plant itself or its fruit. Elderberry, otherwise called European elder or dark senior, is an item that contains arrangements (e.g., juice or extract) of the dark purple product of Sambucus nigra.

Elderberry has been utilized as a medication since ancient times and appeared in various writing of influential Greek and Roman doctors and naturalists, including Hippocrates (ca. Pliny the Elder (ca. 460–370 BCE) 23–79 CE), as well as Pedanius Dioscorides (ca. 40–90 CE)

In laboratory and animal studies, anthocyanins, flavanols, and phenolic acids in elderberry have antioxidant, anti-inflammatory, antiviral, antimicrobial, and immune-stimulating effects. Elderberry preparations’ effects on preventing and treating colds and influenza in human clinical trials have been the subject of promising in vivo and in vitro results.

In August 2022, more than 400 preclinical and human studies on elderberry were included in PubMed, the biomedical research database maintained by the National Library of Medicine. Since 2012, approximately 50 to 80 new studies on this well-known herbal ingredient have appeared to be published annually.

A systematic survey of elderberry for the counteraction and treatment of viral respiratory diseases found that it diminished the seriousness and term of colds and the length of influenza in April 2021. Other elderberry meta-analyses, including one published in 2019, have shown that it may alleviate upper respiratory tract symptoms.

During the second year of the pandemic, elderberry customers continued to focus on immune support in 2021. Supplement users began showing signs of “immune fatigue,” according to industry professionals. Because of this, some businesses and marketers have rethought how they approach the immune health category. One common strategy was incorporating well-known immune ingredients like elderberry into multicomponent formulas with distinct health benefits (like sleep aids and digestive support products).

Since the pandemic began, increased demand for elderberry supplements has raised concerns about the possibility of these products being altered in any way. Elderberry products have recently been adulterated with cheaper, unlabeled ingredients, as documented in this and other recent publications. Elderberry comes from trees that need at least three or four years of growth before they can be harvested, in contrast to some botanical crops that can be grown and harvested quickly to meet spikes in demand.

Ashwagandha

For millennia, Ashwagandha has been used as a “rejuvenator.” Ashwa means “horse,” and gandha means “smell.” The musty-smelling root is thought to give people who eat it the power of a horse. It has traditionally been used, among other things, as an aphrodisiac to boost metabolism and treat fatigue—Ashwagandha in Ayurveda, India’s primary traditional medicine. The herb is an adaptogen that enhances the body’s capacity for stress adaptation.

Ashwagandha was the strongest mainstream sales growth for the second consecutive year in 2021. In 2021, consumers spent 225.9% compared to the previous year, with sales totaling $92,326,926. Ashwagandha appeared among the 40 top-selling ingredients in the mainstream channel in 2018, with less than $7.5 million in sales. Because of this, Ashwagandha’s annual sales have increased by more than 1,100% since then, elevating it from the 34th most popular supplement in this market in 2018 to the seventh position in 2021. Since it first appeared on the top 40 list, mainstream sales of Ashwagandha have more than doubled yearly, except in 2019, when sales increased by approximately 45%.

Many people realized at the beginning of 2021, as the pandemic entered its second year, that the COVID-19 threat was not over. Throughout the year, seasonal waves of the disease’s transmission and the recurring discovery of novel SARS-CoV-2 variants kept the virus at the forefront of many people’s minds.

In this context, it may not surprise that mood-boosting supplements saw significant sales increases in 2021. Ashwagandha product sales marketed for this health focus, which accounted for 96.2% of all mainstream sold in 2021, increased by 272.1% from 2020, representing the highest growth rate in ashwagandha product sales of any health-focused category.

Apple Cider Vinegar

In the mainstream channel in 2021, digestive health was the second most popular health focus for ACV supplements. After “cleanse and detox” products, this category also saw the strongest sales growth. ACV supplements dramatically increased from 2020 to 2021.

Consumers spent $178,382,955, a 128.6% increase from the previous year. ACV was the ingredient in the mainstream market in 2021 that saw a more than 100% sales increase, alongside Ashwagandha. ACV supplements, typically sold as gummies or capsules, first made the mainstream channel’s top 40 list in 2019. Since then, mainstream retailers have seen an increase in these products’ annual sales of over $144.7 million, or roughly 430%.

In the late 1950s, American folk medicine began to use Apple Cider Vinegar powder more and more after D.C. Jarvis, MD, a physician, promoted the book Folk Medicine: Henry Holt published A Vermont Doctor’s Guide to Good Health in 1958. Celebrities have recently announced this well-liked pantry staple, social media influencers, health bloggers, and others for various claimed benefits, such as skin care, digestive health, immune support, weight loss, and numerous other topics.

While many studies have examined the effects of ACV or other culinary vinegar consumed in liquid form, some clinical trials have examined the effects of ACV supplements on weight. A meta-examination distributed in October 2022 inspected the consequences of 11 clinical preliminaries. The authors concluded that vinegar consumption was linked to significant reductions in weight and body mass index (BMI). Still, they also stated that the results had “dubious clinical relevance.” Similarly, in the 2020 systematic review and 2018 small study, excessive vinegar consumption can cause finish disintegration, acid reflux, and aggravation of the throat and stomach. However, levels ordinarily utilized in supplements and culinary applications normally are viewed as protected.

In 2021, some supplement users were experiencing “immune fatigue.” Buying a digestive product with many potential benefits can have also impacted sales. Expanded deals of ACV supplements promoted for stomach-related well-being might have helped the developing group of examination exhibiting an association between stomach well-being and different parts of well-being, like resistance, state of mind, and rest.

Some preliminary studies suggest ACV may delay gastric emptying, which may help lower glucose levels after meals. However, there is limited research on the effects of ACV on digestive health.

Other Increases

In addition to the previously mentioned ingredients, mainstream sales of five additional herbal supplements increased by more than 30% in 2021: Brassicaceae: maca; ivy leaf (62.9 %) (46.8%), fenugreek (39.5%), rhubarb (34.7%), and beetroot (31.1%)

Secondly, Let’s Pay Attention To Natural Channel.

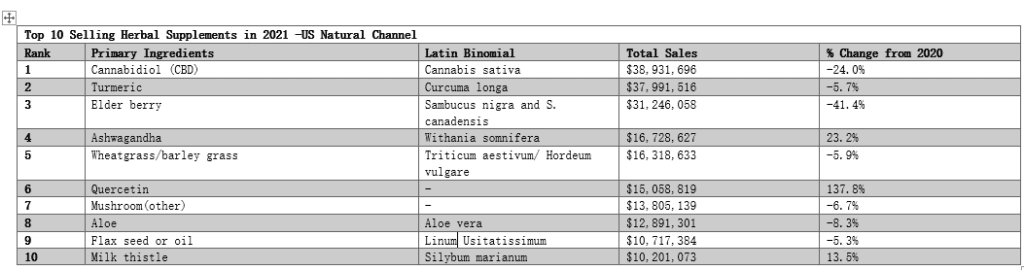

Quercetin

Quercetin saw the strongest sales growth in the natural channel in 2021, with sales more than doubling in comparison to the previous year. In 2021, total sales of $15,058,819 rose by 137.8%. Sales of this ingredient were relatively stable from 2017 to 2019, but they have since increased. In natural retail stores, quercetin experienced the second-highest sales growth in 2020 (74.1%). Quercetin sales have increased by 300% since it first appeared on this channel’s top 40 list in 2017, moving it from the 26th most popular supplement in 2017 to the sixth most popular supplement in 2021.

Quercetin is a type of pigment plant called a flavonol. Flavonoids are found in plants. This undeniably unique phytochemical is tracked down in many foods grown from the ground, with probably the most elevated amounts revealed in onions (Allium cepa, Amaryllidaceae), asparagus (Asparagus officinalis, Asparagaceae), apples, and cherries (Prunus spp., Rosaceae). Research facilities and animal studies recommend that quercetin has cell reinforcement, mitigating, immunomodulatory, antiviral, and neuroprotective properties. This ingredient has various purposes, including for invulnerable help, sensitivities, cardiovascular issues (e.g., elevated cholesterol and circulatory strain), and prostate conditions.

Other Increases

In addition to quercetin, natural retail stores saw sales increases of more than 30% in 2021 for three additional ingredients;

- ACV supplements in the crude market totaled $7,685,405—a 104.7% increase from 2020.

- From 2020 to 2021, sales of chlorophyll/chlorella supplements increased by 43.3%, reaching $7,404,013.

- In 2021, sales of beetroot supplements in the natural market reached $5,338,296—a 41.3% increase from 2020.

Sales Decreases

In 2021, sales of four herbal supplements in the natural channel decreased by more than 30%: Elderberry, oregano, echinacea and echinacea-goldenseal

- Elderberry and oregano sales in natural channels decreased by 41.4% and 30.7%, respectively, in 2021.

- Even though echinacea and echinacea-goldenseal product sales fell by 39% and 25%, respectively, in 2021, they were still significantly lower than in 2019.

Finally, Let’s Notice Direct Sales Channel.

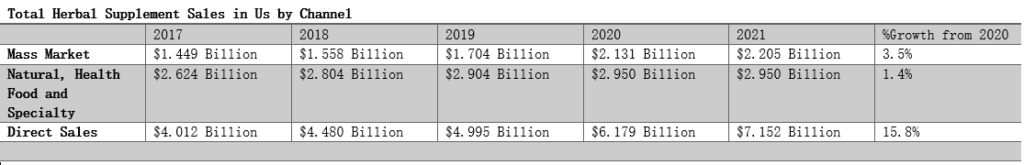

Out of NBJ’s three market channels, the direct sales channel experienced the strongest sales growth in 2021. This was the case from 2017 to 2019, but in 2020, mass market channel sales growth briefly surpassed direct sales growth. In 2021, herbal supplement direct sales increased by 15.8%, less than the 23.7% growth in 2020.

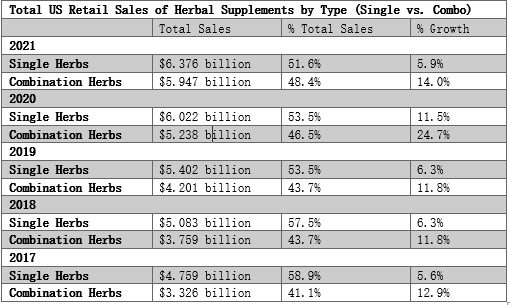

Single VS Combination Herbs

In 2021, sales growth of combination herbal formulas outpaced that of single-herb supplements. Combination products saw a 14% increase in consumer spending in 2021, more than doubling the growth in sales of single-herb accessories (5.9%). Since 2011, combination products’ annual sales growth has been greater than single-herb products.