According to Nutrition Business Journal data, the global dietary supplement market reached $156.2 billion in 2020, a year-on-year increase of 9.7%. The consumption areas of global nutritional supplements are mainly distributed in countries and regions like the United States, Europe, Asia, and so on. Among them, the United States, the European Union, Canada, Australia, Japan, and other industries developed earlier, the market is relatively mature, and the consumer demand is relatively stable.

According to reports, three-quarters of U.S. adults take dietary supplements as part of their daily health management, which has remained stable for many years. In Japan, functionally labeled food has become commonplace in supermarkets, convenience stores, and other distribution channels. China, ASEAN, Brazil, and other emerging markets as dietary supplements have grown rapidly in recent years.

The U.S. holds the largest dietary supplement market share.

The United States is the world’s largest dietary supplement market and the country with the highest penetration rate of nutritional supplements. The U.S. dietary supplement industry developed earlier, and the market is relatively mature.

In 2020, the U.S. dietary supplement market sales will be approximately $55.7 billion. American adults use nutritional supplements as part of their daily health management. Among them, vitamins and minerals are the most commonly consumed categories, which are used by about 76% of the population. The second most popular category is specialty nutritional supplements, with a usage rate of about 40%. It is followed by herbal and plant extract products with a usage rate of 39%. The use of sports nutrition supplements was 28%. The use of weight management supplements was 17%.

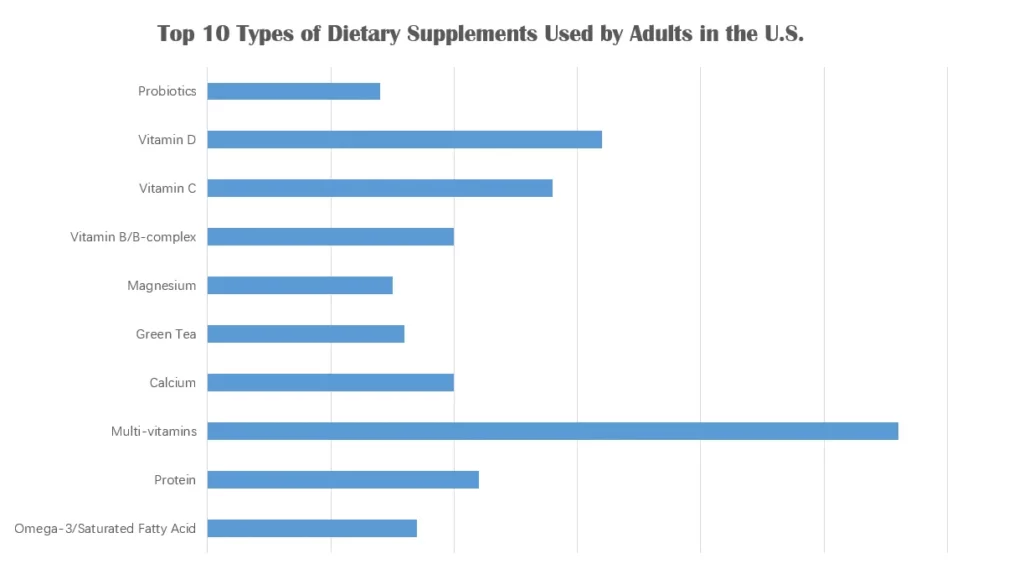

The top three product types consumed in the United States are multivitamins, vitamin D, and vitamin C, accounting for 58%, 31%, and 28%, respectively. Followed by protein products and vitamin B products.

In addition, American consumers are more concerned about cognitive, emotional, sleep, and bone health. Particular attention is paid to immune health. U.S. sales of supplements that support the immune system rose 32.4 percent, according to Euromonitor. Of this, total sales in 2020 were $2.7 billion. And, globally, sales of supplements that support the immune system reached $7.9 billion in 2020.

In addition to the high consumption of vitamins and minerals, some new ingredients are also favored by American consumers. According to SPINS data, Ashwagandha extract powder, the most popular ingredient in the U.S. market in 2021, has the highest growth rate, reaching 165.5%. The growth rate was 65% and 60.6%, followed by mushroom extract powder and dandelion extract powder. In addition, superfoods, melatonin powder, caffeine powder, vitamin D, and super mushrooms also have a certain growth.

In terms of dosage form, gummies were the fastest-growing dosage form, with sales up 27.4%. Consumers also embraced supplements in the form of ready-to-drink beverages, with sales up 17.7 percent. Traditional dosage forms such as hard capsules, soft capsules, and oral liquids have also achieved certain growth. Conversely, sales of granular products fell 33%. It shows that a convenient and quick-to-take product is an important consideration for consumers when choosing a supplement.

Regarding ingredient benefits, sales of supplements containing superfoods were the fastest growing, with an annual growth rate of 147.1%. Supplements containing apple cider vinegar and emotional attention support increased by 165.3% and 43%, respectively. It can be seen from these data that consumers are more inclined to obtain nutrition through ordinary food with certain health effects.

The EU supplement market has a high compound growth rate.

According to Euromonitor data, the E.U. food supplement retail market was worth $22.69 billion in 2020, with a compound growth rate of 4.2% from 2015 to 2020. The retail market is expected to reach $31.65 billion in 2025.

The main consumer goods categories for E.U. consumers are vitamins, minerals, weight management, and sports nutrition products.

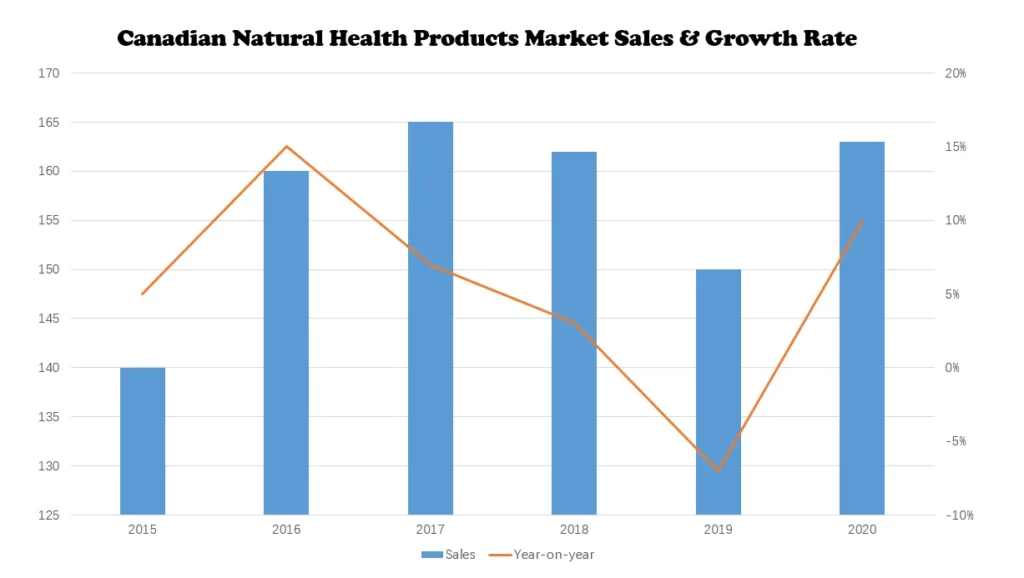

Natural health products have great potential in Canada.

The dietary supplement market in Canada includes natural health products and nutritional supplements.

According to Statista 2021 statistics, the sales of dietary supplements in Canada will increase from RMB 13.18 billion in 2014 to RMB 17.04 billion in 2020. And the compound annual growth rate is 3.7%. Affected by the new crown epidemic, Canadian consumers have increased their purchases of natural health products. The total sales in the first half of 2021 were RMB 8.76 billion, a year-on-year increase of 6% compared to the first half of 2020.

Expanding exports is the way to go for Australia’s market.

With the acceptance and widespread use of dietary supplements by Australian consumers, especially the growing demand in overseas markets, the Australian nutritional supplement industry is developing rapidly, and the industry continues to prosper.

According to statistics, there are 82 dietary supplement manufacturers in Australia, with an output value of AUD 4.9 billion in 2017. Recently, 71 new ingredients have been approved by the Australian Therapeutic Goods Administration, simply called TGA.

Export growth is the main driving force behind the rapid development of the Australian dietary supplement market. More than 60% of Australian companies are engaged in the export business. Mainland China, New Zealand, Hong Kong, Japan and South Korea and the ASEAN region are its main export markets.

From the perspective of the development size of the Australian dietary supplement market, the largest scale is still vitamin and mineral products, with a ranking of AUD 2.77 billion. It is followed by sports nutrition products with a scale of 1 billion Australian dollars. The scale of weight control products also reached AUD 430 million. In terms of hot-selling categories, the top five fastest-growing categories are probiotics, propolis, calcium, chlorophyll, and cranberry products, with an increase of 10.2%, 9.6%, 9.1%, 7.4%, and 6.9%, respectively.

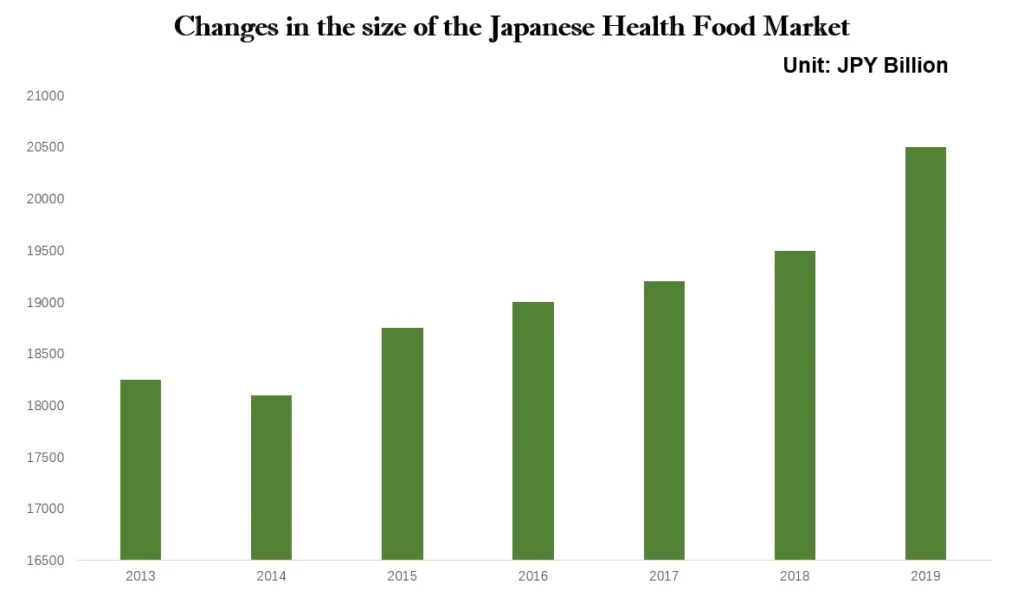

Gut health is the most popular product type in Japan.

According to official data, the amount of food consumed by Japanese households to maintain and improve health was JPY 8,717 from January to June 2021, an average of JPY 1,453 per month. The functionalization of ordinary food has long been a part of Japanese life.

The functionally labeled food system (recording system) implemented on April 1, 2015, has greatly promoted the development of the Japanese dietary supplement industry. Functionally labeled foods have appeared in all circulation channels, such as supermarkets and convenience stores. Clear functional labels have greatly increased market activity and facilitated the entry of these products into overseas markets.

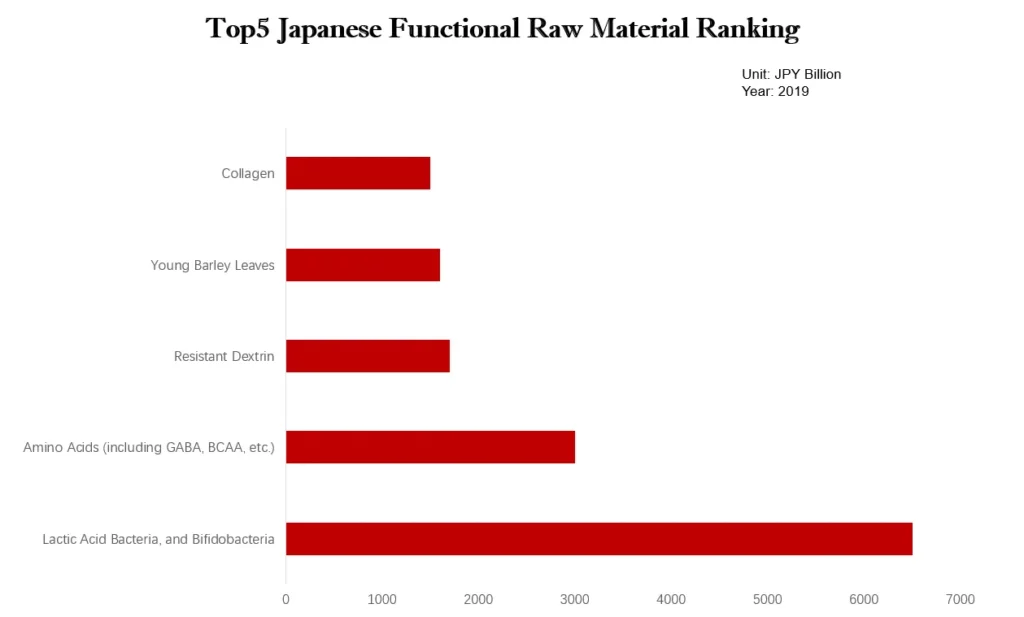

In 2019, the TOP5 markets ranked by functional ingredients were as follows:

- Lactic acid bacteria and bifidobacteria: JPY 629 billion

- Amino acids (including GABA, BCAA powder, etc.): JPY 262 billion

- Resistant dextrin: JPY 67 billion

- Young barley leaves: JPY 64 billion

- Collagen: JPY 62 billion

The top 5 markets ranked by functional utility are as follows:

- Intestinal regulation (intestinal environment): JPY 661 billion

- Overall balance (everyday health): JPY 383 billion

- Beauty and skin care: JPY 172 billion

- Anti-obesity (weight loss): JPY 152 billion

- Exercise (muscle dose): JPY 69 billion

Lactic acid bacteria and bifidobacteria have achieved stable development as the main supplement ingredients for intestinal regulation (intestinal environment). According to data from TPC marketing research, the market size of lactic acid bacteria-related products in Japan in 2019 reached JPY 863.9 billion, an increase of 55.8% compared to 2009. Among them, yogurt and lactic acid bacteria drinks accounted for nearly 90% of the market share. In 2020, due to the needs of home life due to the epidemic, the demand for yogurt products was high, and the market for lactic acid bacteria-related products is expected to grow to a certain extent.

Give more expectations in China’s dietary supplement market.

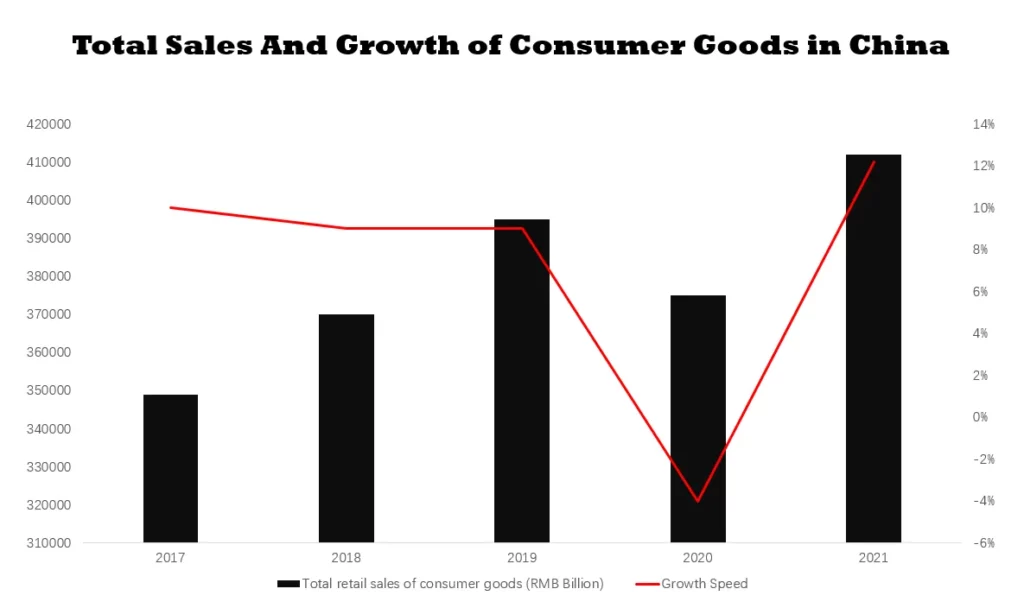

The new crown epidemic has recently hit China’s dietary supplement market. The industrial chain has been challenged, and the logistics chain has been hit hard. However, China’s dietary supplement market still maintains a good development momentum. In 2021, the operating income of most related companies in China will increase to varying degrees.

For example, By-Health achieved operating revenue of RMB 7.43 billion in 2021, an increase of 21.9% over the same period in 2020. And the net profit attributable to By-Health’s parent company was RMB 1.75 billion, a year-on-year increase of 15.1%. The operating income of Join care in 2021 will be RMB 15.90 billion, a year-on-year increase of 17.6%, and its net profit will be RMB 1.33 billion, a year-on-year increase of 18.6%.

Good trade has been maintained about the import and export of nutritional supplements, and the import and export value has increased. The China Medical Insurance Chamber of Commerce statistic that China’s imports of dietary supplements in 2021 were $5.18 billion, a year-on-year increase of 7.8%. Exports were $2.62 billion, a year-on-year increase of 19.9%. Both imports and exports hit a record high.

Due to the new crown epidemic outbreak, Chinese consumers have increased their attention to immunity-boosting products. According to related reports, elderberry products are selling well. Vitamin and mineral products also maintained a good growth trend.

Under the influence of the “appearance economy,” oral beauty and anti-aging products are favored by consumers, such as bird’s nests and collagen products. Gastrointestinal health and bone health are the hotspots that consumers continue to pay attention to. Probiotic products and ammonia sugar products are the hottest categories in recent years.

In addition, eye health products and sleep aid products in the dietary supplement market also have great potential for development. At the same time, new special dosage forms of health food, sports nutrition food, and food-like health food-like products represented by gummies are constantly being favored by young consumers. China’s dietary supplement industry is flourishing.

Conclusion

From the above, obviously, the United States currently dominates the global dietary supplement market. However, such a market landscape may undergo some changes in the next few years. China and Japan are both rapidly growing markets for nutritional supplements, and their growth is only likely to continue. Australia and Canada are also significant players in the market, although they are expected to experience a different level of development than China and Japan. The dietary supplement market is an ever-changing landscape, and related companies must be prepared for these changes if the company wants to stay ahead of the competition.