Nutritional vitamin ingredients are a huge family. There are dozens of vitamins currently known, roughly divided into two categories: fat-soluble and water-soluble.

- Fat-soluble vitamins

- vitamin A powder

- vitamin D powder

- vitamin E powder

- vitamin K powder, etc.

- In B vitamins, water-soluble vitamins:

- vitamin B1 powder

- vitamin B2 powder

- vitamin B5 powder

- vitamin B6 powder

- vitamin B7 powder

- vitamin B12 powder

- vitamin C powder(Ascorbic Acid powder)

- niacinamide powder, etc.

Global Nutritional Vitamin Ingredients Market Share & Size

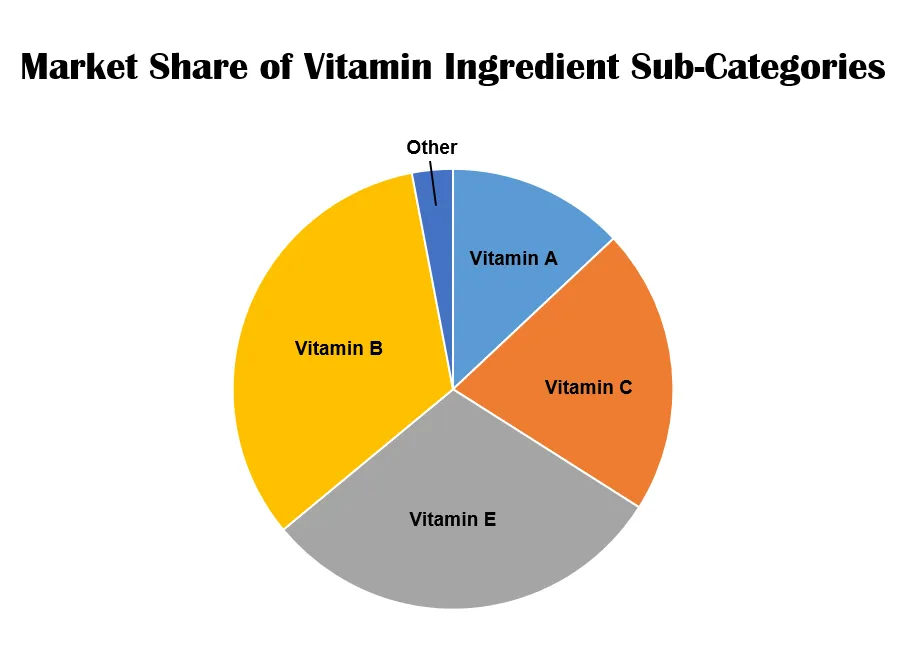

From the perspective of acquisition methods, vitamins can be divided into natural products and chemical synthetic products. Because raw materials and extraction technology limit natural vitamins, the output is low, and the price is high, so the current chemically synthesized vitamin raw materials dominate the market, accounting for about 80% of the total output of vitamins. Among the various sub-categories of nutritional vitamin ingredients, vitamin B, vitamin E, vitamin C, and vitamin A have a larger market share, about 33%, 30%, 21%, and 13%, respectively.

At present, China is the world’s largest producer of nutritional vitamin ingredients. Each product segment has about 5-8 manufacturers. By optimizing and enriching the type and structure of vitamin raw materials, various enterprises have deployed multiple varieties to avoid the impact of single product price fluctuations on the company’s performance. However, this has led to a fragmented competitive landscape for nutritional vitamin ingredients in China, with serious product homogeneity and fierce price competition.

For example, in the vitamin E market, the global production capacity is mainly concentrated in five companies, of which China accounts for three, as follows:

- Zhejiang Pharmaceutical Co., Ltd.

- Zhejiang Xinhecheng Co., Ltd.

- Nengte Technology Co., Ltd.

The vitamin production capacity of these three companies accounts for about 45% of the global market share.

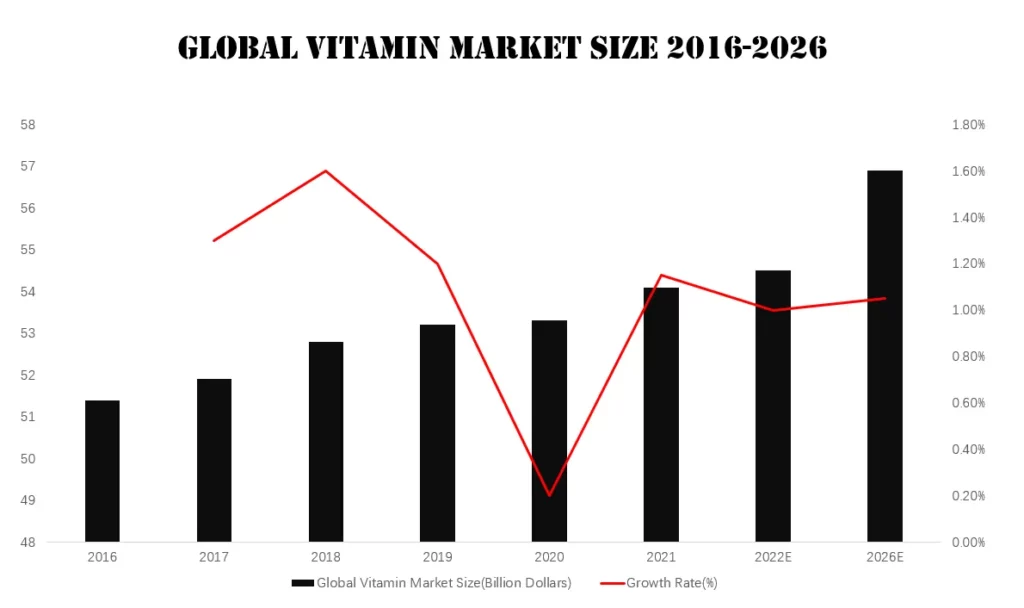

The main foreign suppliers are DSM and BASF, which mainly produce high-end pharmaceutical-grade products, accounting for 55% of the global market. According to data, the global vitamin raw material market size reached $5.14 billion in 2016 and will grow to $5.42 billion in 2021. It is expected that the compound growth rate of the market scale will reach 1.0% from 2022 to 2026, and the global vitamin raw material market size will reach $5.70 billion by 2026.

What are the Problems with the Vitamin Ingredients Market?

Inappropriate market operations lead to overcapacity.

In 2020, due to restructuring, suspension of production and price protection, raw materials prices rose, and the export volume increased significantly, easing the relationship between market supply and demand. The price of raw vitamin materials gradually moved out of the bottom space and rose slightly. But simultaneously, because there are seriously oversold manufacturers, it still takes time to digest large-scale production capacity.

Different vitamin categories have their own industry barriers.

In terms of industry barriers, the intermediate synthesis technical barriers of vitamin A, vitamin B7 (biotin), vitamin D3 and vitamin E, among common vitamins, are high; the technical synthesis barriers of raw materials such as vitamin A, vitamin B1 and biotin are high; in addition, The environmental barriers for the synthesis of vitamin B5 (pantothenic acid) and vitamin B9 (folic acid) are high.

Vitamin market concentration is problematic.

The market concentration of nutritional vitamin ingredients with certain technical barriers is relatively high, such as vitamin B1, vitamin B2, vitamin B6, vitamin B7, and vitamin B9. These nutritional vitamin ingredients have formed a typical oligopoly pattern.

There is a serious overcapacity phenomenon for some raw materials with low technical barriers, such as vitamin C. Although the 5 manufacturers have mastered the main production capacity, there are too many small production capacities, and the industry concentration is low.

Applications of Nutritional Vitamin Ingredients

The downstream applications of nutritional vitamin ingredients mainly include three application directions: feed, pharmaceutical cosmetics, and food and beverage.

- The feed industry has the greatest demand, reaching 48%.

- The demand for pharmaceutical cosmetics and food and beverage industries accounted for 30% and 22%, respectively. Among them, vitamin D3, vitamin A, and B7 are the largest feed applications. Vitamin C is mainly used in the food and beverage industry.

How is the Import and Export Trade of Vitamin Ingredients?

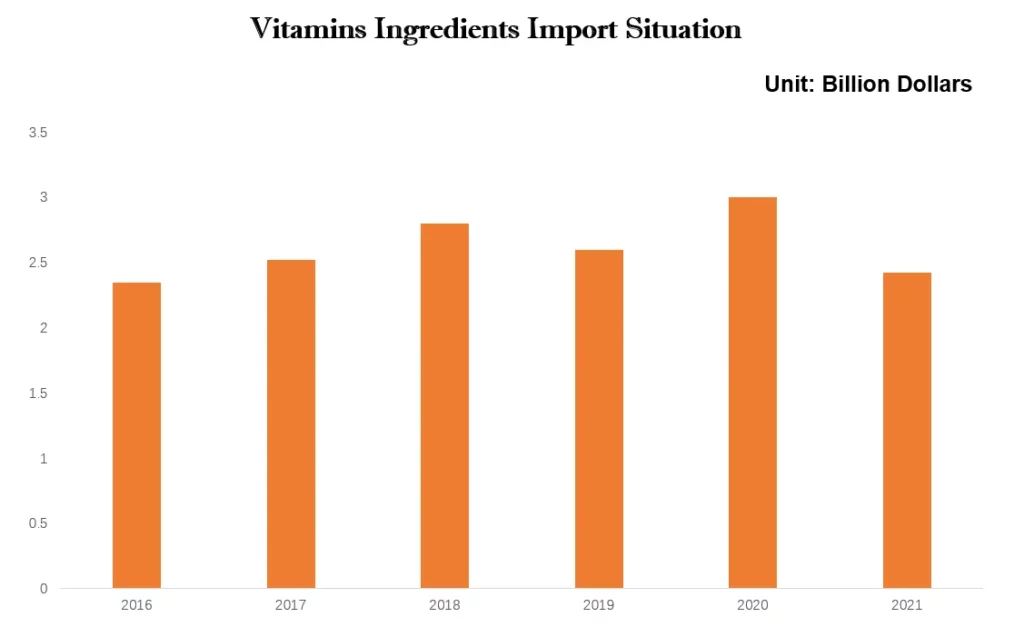

In 2021, the total import and export of vitamins will be 3.96 billion US dollars, of which exports will be 3.71 billion US dollars, a year-on-year increase of 14.1%. Imports totaled $280 million.

The export trade value accounts for 93.5% of the total vitamin trade. From 2016 to 2021, the export of nutritional vitamin ingredients showed intermittent growth. Among them, the export value in 2018 and 2021 is relatively high. The value of exports in 2016 and 2019 was relatively low. Generally, the unit price of vitamins exported is relatively stable, with slight fluctuations.

In terms of export markets, the top five markets in 2021 are the United States, Germany, the Netherlands, Japan, and Brazil. The five major markets’ exports were $970 million, $440 million, $340 million, $140 million, and $140 million, respectively. Among them, the United States is one of the most important export markets, accounting for 26.1%. From 2016, the top five markets for vitamin exports were relatively stable. From the perspective of export prices, the overall price of vitamins in 2021 will increase by 7.5% year-on-year. The export unit price of vitamins C and E increased, and the price of pantothenic acid decreased greatly.

From the import value from 2016 to 2021, the import shows a wave shape. The import value in 2020 is higher, with a total of 320 million US dollars. The top five markets for imports are Switzerland, Germany, the United States, France, and Japan. Among them, Switzerland, Germany, and the United States are the main importing countries, accounting for 72% of the total. In terms of types, the main imported categories are vitamin A and derivatives and vitamin E and derivatives. From the perspective of import unit price, vitamin E and its derivatives, vitamin B2 and derivatives have increased significantly. The unit price of vitamin B12 and its derivatives has dropped significantly, down 92.3% year-on-year.

Types of Nutritional Vitamin Ingredients Market Details

Vitamin D

Vitamin D is divided into vitamin D3 and D2, and the market for vitamin D3 powder is dominant. Vitamin D is widely used in feed additives, food additives, nutraceuticals and biomedicines. This ingredient regulates calcium phosphate exchange and is essential for bone growth. It also promotes cell differentiation and boosts immunity.

The global vitamin D market size was $540 million in 2016 and will grow to $990 million in 2021. It can see that the compound annual growth rate is 12.9%. It is expected to reach $1.91 billion in 2026.

In 2021, dietary supplements will account for 16.2% of vitamin D consumption, and food and other fields will account for 83.8%.

In 2016, the vitamin D share of the North American market was 43.2%, occupying the largest market. Next, in order of market share, is in Europe, Asia Pacific, and other regions. By 2021, the shares of these four major markets will be 47.3%, 29.1%, 20.2%, and 3.5%, respectively. Market share in North America and Europe showed a significant growth trend, while the market share in Asia Pacific was downward. However, the Asia-Pacific market is still growing due to the increase in the total market volume.

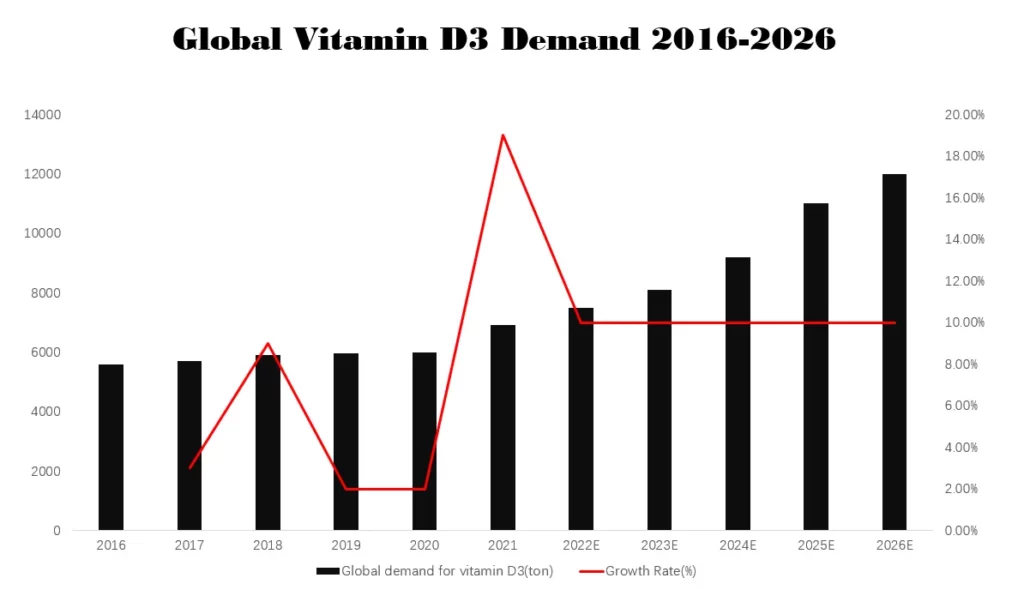

Let’s take vitamin D3 powder as an example. Its demand accounts for about 89% of feed applications, 6% of pharmaceutical applications, and 5% of food applications. According to the survey data, vitamin D3 reached 5,000 tons in 2016 and will increase to 7,000 tons in 2021, with a compound annual growth rate of 6.6%. It is predicted to reach 12,000 tons by 2026.

Vitamin E

Vitamin E is divided into natural vitamin E and synthetic vitamin E.

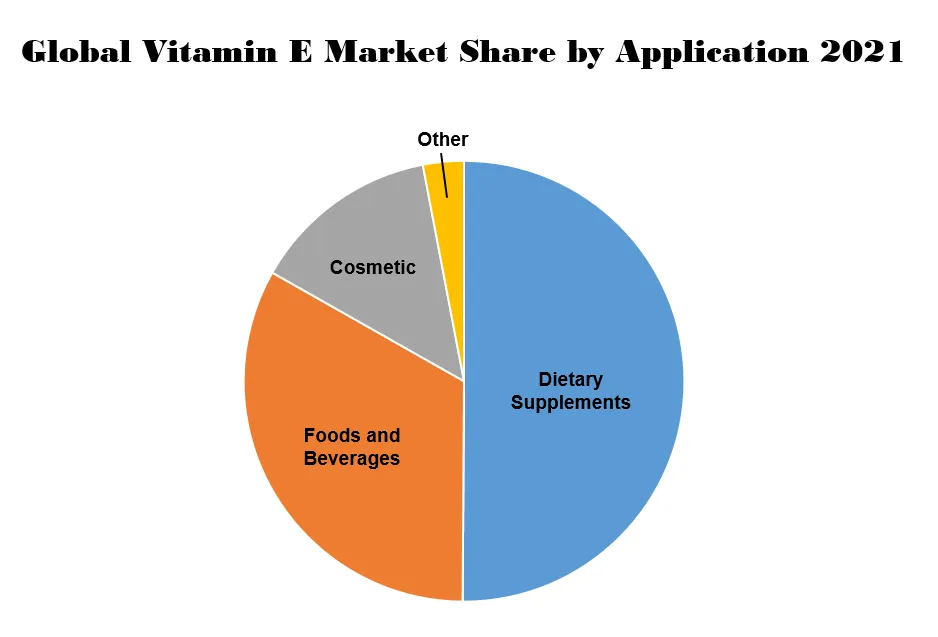

At present, the application of natural vitamin E in dietary supplements accounts for nearly 50% of the entire market, the food and beverage industry accounts for 32%, and the cosmetics industry accounts for 11%. Synthetic products are generally used as feed additives.

According to statistics, the global vitamin E market reached USD 1.65 billion in 2016 and will grow to USD 1.74 billion in 2021. It is expected to reach $1.82 billion by 2026. Among them, North America occupies the largest market share.

According to customs data, vitamin E raw material imports are on a downward trend. In particular, the import value in 2021 is 47.435 million US dollars, a decrease of -44.7% compared with the import volume in 2016. The top five import markets for vitamin E ingredients in 2021 are the United States, Switzerland, Germany, France, and Japan. The concentration is very high, accounting for 95.2%, of which the United States accounts for 37.2% of the entire import value. From the perspective of the import market over the years, Switzerland has been the first import market for many years, but since 2018, the import share has dropped significantly, and the import volume has dropped by 76.2% year-on-year.

There are twists and turns in the process of exporting vitamin E ingredients. But the overall trend is still increasing. In particular, exports will grow rapidly in 2021, reaching $850 million, a year-on-year increase of 33.9%. The top five markets for vitamin E raw material exports in 2021 are the United States, Germany, the Netherlands, Brazil, and Japan.

Vitamin K

The global vitamin K market size reached USD 160 million in 2016 and grew to USD 260 million in 2021. It is expected to reach $420 million in 2026. Regarding market application, in 2021, dietary supplements will be the main application market for vitamin K raw materials, accounting for about 76.1% of consumption. Food and other fields will account for about 23.9%.

Conclusion

There is no doubt that the nutritional vitamin ingredients industry will continue to grow in popularity due to its many benefits. And at the same time, the vitamin ingredients market is young but growing quickly. It bodes well for the future of these ingredients as they become ever more popular with consumers interested in living healthier lives.